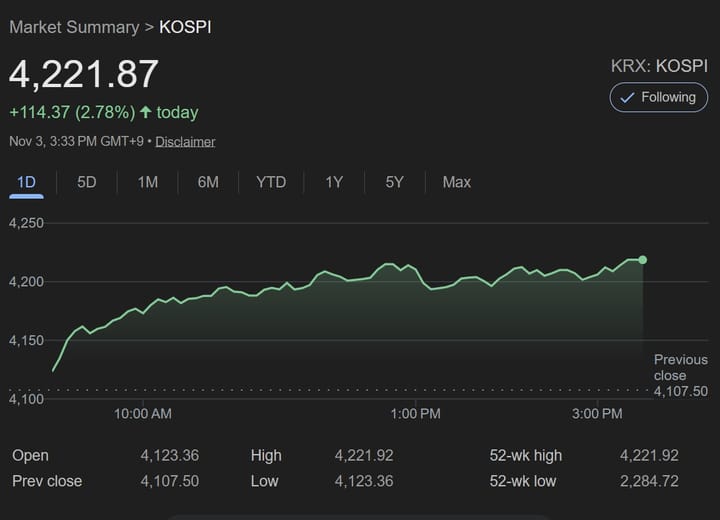

Bank Bond Issuance and Credit Spreads: Why Conventional Wisdom May Be Wrong

Understanding the "Productive Finance Transformation" Impact

Last week, we examined how the "Productive Finance Transformation" policy direction would affect bank bond issuance. The conclusion was clear: from a long-term perspective, this policy is unlikely to directly impact bank loan growth trends, and bank bond issuance volumes will correspondingly fluctuate in tandem.

But this raises an important question: If household loan growth slows and corporate lending stabilizes as the market expects, will bank bond issuance decline and credit spreads continue their downward stabilization?

Challenging Market Assumptions About Credit Spreads

Conventional wisdom suggests a straightforward relationship:

- When household loans increase → bank bond issuance rises → credit spreads widen

- When household loans decrease → the opposite occurs

However, historical data tells a different story.

The Post-COVID Paradox

After analyzing past data, we reached conclusions that diverge from common assumptions. Following COVID-19, household loans surged most dramatically during 2020-2021, with another growth phase in 2025. Yet during these rapid growth periods, credit spreads (including bank bonds) showed downward stabilization — contradicting conventional expectations.

The Real Driver: Liquidity Dynamics

The user wants this optimized for SEO, so I should make sure to use relevant keywords naturally throughout, create scannable sections, and structure it well. Let me continue with the article

Why Does This Happen?

The answer lies in simultaneous expansion: as household loans increased, market liquidity grew concurrently, positively impacting overall financial market liquidity.

While short-term supply pressure from loan growth may temporarily widen credit spreads, accumulated liquidity eventually flows into capital markets, creating a mechanism that ultimately benefits bond supply-demand dynamics.

Data correlation confirms this: Year-over-year household loan and money supply (M2) growth rates show synchronized movement during the observation period.

Applying This Framework to 2025 Market Trends

Let's examine how this causality applies to this year's credit market performance:

After initial year effects plateaued, credit spreads regained strength mid-year. While rising market rates played a role, household loan growth likely had a significantly greater impact than previously understood.

This insight has major implications for projecting 2026 market direction regarding bank bond supply-demand dynamics.

2026 Outlook: What to Expect

Slowing Loan Growth Trajectory

With policy orientation shifting toward productive finance, bank loan growth will likely decelerate compared to 2025. Why? Corporate loan growth cannot quickly compensate for slowing household loan expansion.

Implications for credit markets:

- Bank bond supply-demand impact on credit spreads should moderate versus 2025

- Overall pressure on credit markets may decrease

The Wildcard: Funding-Side Pressures

Beyond these projections, bank bond net issuance faces another potential variable.

Emerging Deposit Challenges

Since October, as lending tightened, commercial banks' demand deposit balances have declined significantly month-over-month. This has increased bank bond issuance despite slowing household loan growth.

Key shift: Previously, supply-demand concerns focused on loan deployment. Now, we must also consider funding-side dynamics — and this shift may arrive sooner than anticipated.

Investment Implications

For fixed-income investors and market participants, these findings suggest:

- Reassess conventional spread-loan correlations with liquidity context

- Monitor M2 growth alongside loan data for better spread predictions

- Watch deposit flows carefully as a new supply driver

- Expect moderating but not absent supply pressure in 2026

Source: Hana Securities Research Center

Author: Park Jung-ho, Financial Reporter

Analysis Period: Post-COVID through October 2025