Korea ETF Market Surges to ₩267.5 Trillion on Semiconductor and China EV Rally

SEOUL, Oct. 31 (Korea Economy News) — Korea’s exchange-traded product (ETP) market delivered strong growth in September 2025, as leveraged semiconductor and China EV funds fueled a surge in trading and asset inflows, lifting total ETF and ETN assets to a new record

The Securities and Futures Markets Department of the Korea Exchange (KRX) announced September ETF and ETN market trends and statistics. As of the end of September 2025, the total assets of the Korean ETF and ETN market reached approximately KRW 267.5 trillion (KRW 249.8 trillion for ETFs and KRW 17.7 trillion for ETNs), representing a KRW 19.23 trillion (+7.7%) increase from the previous month.

According to the Korea Exchange’s ETF·ETN Monthly Report for October, the combined market capitalization of ETFs and ETNs reached ₩267.5 trillion, up 7.7 percent from a month earlier. ETFs accounted for ₩249.8 trillion, while ETNs rose to ₩17.7 trillion. The number of listed products climbed to 1,435, comprising 1,029 ETFs and 406 ETNs, marking continued market diversification.

Trading Activity Jumps to ₩5.7 Trillion a Day

Average daily turnover jumped 11.9 percent month-on-month to ₩5.7 trillion, led by leveraged index and thematic products tied to the KOSPI 200 and technology sectors. ETF trading made up ₩5.586 trillion, while ETN trading contributed ₩144 billion per day.

Analysts attributed the uptick to strong retail participation and algorithmic trading strategies taking advantage of short-term momentum in chip-related themes.

Top Funds by Assets

The largest ETFs by assets were TIGER S&P500 (₩9.79 trillion), KODEX 200 (₩8.89 trillion), and KODEX CD Rate Active (₩8.79 trillion).

Together, these three products represent nearly 11 percent of the total ETF market. The growing dominance of U.S. equity and domestic blue-chip exposure reflects the continued preference for stable core benchmarks, even as retail traders flock to leveraged instruments.

Most Actively Traded ETFs

Daily trading was concentrated in a handful of high-volatility products:

- KODEX Leverage: ₩544.6 billion/day

- KODEX 200: ₩475.4 billion/day

- KODEX 200 Futures Inverse 2X: ₩394.3 billion/day

These three funds alone accounted for over 25 percent of total ETF turnover, underscoring the speculative tone that dominated September’s trading pattern.

Performance Highlights

The best-performing ETFs were dominated by leveraged plays in semiconductor and China EV industries.

- TIGER China EV Leverage: +52.3%

- KODEX Semiconductor Leverage: +47.8%

- TIGER Semiconductor TOP10 Leverage: +46.9%

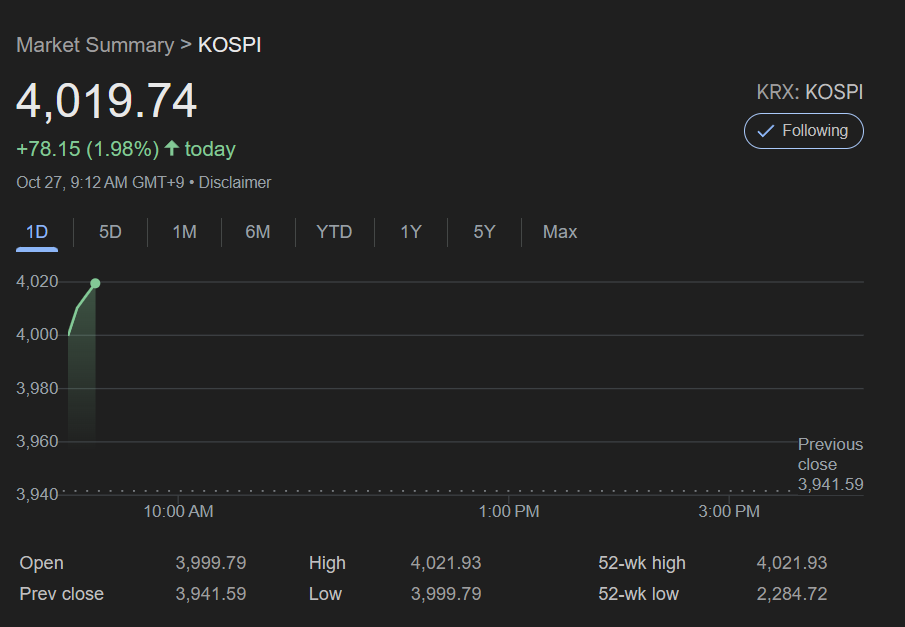

These returns far outpaced the KOSPI’s 2.6% monthly gain, showing the impact of sector-specific leverage and rising optimism over the global tech cycle.

In the ETN space, the Leverage KRX Gold Spot ETN returned +60.6%, boosted by rising global gold prices amid expectations of monetary easing in major economies.

New Listings Expand Thematic Diversity

Fourteen new ETFs and ETNs were introduced during the month, broadening Korea’s thematic coverage across defense, clean energy, nuclear power, AI infrastructure, and high-dividend strategies.

Notable launches included:

- KODEX K-Defense TOP10 Leverage (Sept 16)

- KODEX K-Nuclear SMR (Sept 16)

- ACE Europe Defense TOP10 (Sept 23)

- RISE AI Power Infrastructure (Sept 23)

The wave of new listings underscores the KRX’s effort to localize global investment trends and offer investors access to strategic industries aligned with national competitiveness and energy transition.

Sector Rotation and Investor Trends

Market strategists noted that the September surge was driven by retail traders reallocating funds from traditional dividend ETFs toward thematic leverage and growth sectors.

Institutional investors, meanwhile, continued to build positions in short-term rate products such as KODEX CD Rate Active, reflecting expectations that the Bank of Korea could begin rate cuts in early 2026.

The semiconductor rebound, combined with China’s new EV subsidies and U.S. tech resilience, triggered cross-border inflows into related Korean ETFs.

Global liquidity conditions also improved, with expectations that the Federal Reserve’s tightening cycle was nearing an end, further fueling appetite for risk assets.

Market Outlook

Analysts expect ETF inflows to remain robust through Q4 2025 as the market heads toward record year-end volumes. Leveraged semiconductor and AI infrastructure funds are likely to stay in focus, while newly launched defense and SMR products could attract mid- to long-term thematic investors.

The Korea Exchange said it plans to continue expanding index offerings in partnership with local and global providers to enhance product differentiation and global visibility.

Subscribe to Korea Economy News for weekly ETF flows, sector rotation analysis, and thematic market updates.