Korea ETF Weekley-Foreign buyers turn selective; semiconductor strength offsets weakness in EV themes

Semiconductor-led ETFs advanced while EV/battery themes weakened. Foreign investors turned selective net buyers and core Korea beta stabilized.

Foreign buyers turn selective; semiconductor strength offsets weakness in EV themes

Daily ETF Market Overview

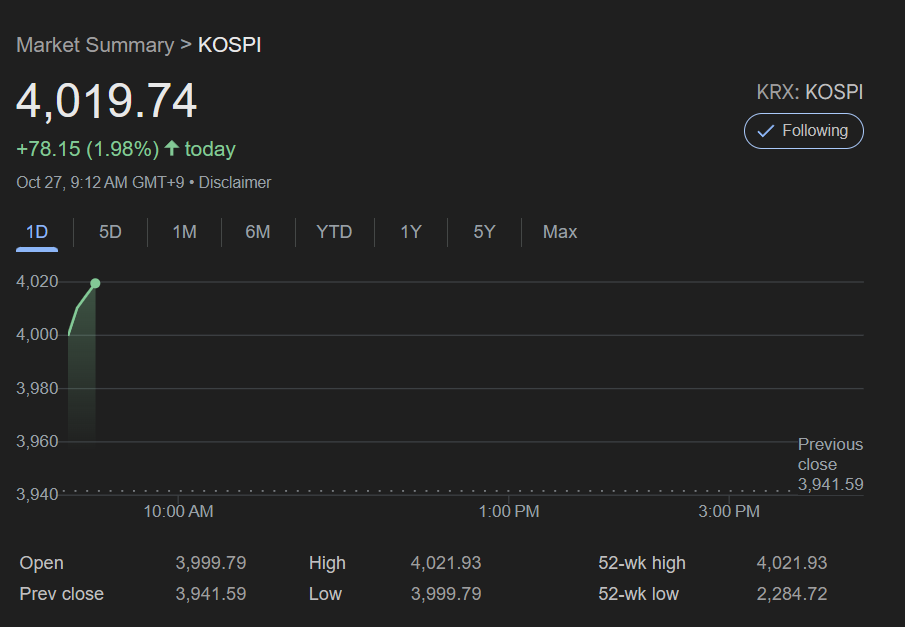

Korea’s equity complex closed mixed as large-cap technology stabilized the tape while high-beta themes (EV/battery, internet/growth) underperformed. Semiconductor-linked ETFs outpaced the field on continued AI memory optimism tied to Samsung Electronics and SK Hynix, echoing the relative bid seen in U.S. SOXX/SMH. Broader beta (KOSPI baskets) finished flat-to-slightly higher, whereas KOSDAQ exposure faded as speculative momentum cooled.

Fund Flow Summary (Top Inflow / Outflow)

Inflow leaders concentrated in semis and value-weighted core Korea exposure; outflows centered on EV/battery and China-sensitive funds.

Top Estimated Inflows (Daily)

| Rank | ETF | Ticker | Read |

|---|---|---|---|

| 1 | KODEX Semiconductor | 091160 | Inflows in the low-to-mid billions KRW; AI memory bid intact |

| 2 | TIGER KOSPI 200 | 102110 | Core beta accumulation; value tilt noticeable |

| 3 | KODEX MSCI Korea | 152280 | Foreign basket buying on large-cap tech |

| 4 | HANARO KRX 300 | 304940 | Broad market stability flows |

| 5 | TIGER Value Plus | 210780 | Rotation toward low-vol/value continues |

Top Estimated Outflows (Daily)

| Rank | ETF | Ticker | Read |

|---|---|---|---|

| 1 | KODEX Secondary Battery | 305720 | Light-to-moderate outflows; margin/ASP overhang |

| 2 | TIGER China Electric Vehicle | 371460 | China demand concerns; cross-border sentiment soft |

| 3 | KODEX KOSDAQ 150 | 229200 | Growth de-risking; speculative beta cools |

| 4 | TIGER Game Industry | 311390 | Risk appetite weak; positioning light |

| 5 | ARIRANG K-New Deal | 269370 | Theme fatigue amid higher-for-longer rates narrative |

Read-through: The mix signals quality-growth over high-duration growth. Foreigners appear to be adding core exposure while trimming cyclical/thematic volatility.

Sector Rotation Map

| Sector / Theme | Tape | Takeaway |

|---|---|---|

| Semiconductors | ↑ | Tracks U.S. SOXX/SMH strength; HBM/AI server cycle still the anchor |

| Value / Large-Cap Core | ↑ | Liquidity preference; institutions add low-vol beta |

| Financials | = | Earnings/credit quality watch; rotation candidate if yields stabilize further |

| Internet / Platform | ± | Range-bound; conviction limited outside mega-cap |

| EV & Battery | ↓ | Pricing/margin uncertainty; order visibility mixed |

| Healthcare/Biotech | ↓ | Speculative flows light; catalyst-driven only |

| China-linked | ↓ | Cross-border risk premium persists |

Interpretation: Leadership remains narrow (semis + selective value). A healthier extension would need participation from financials/industrials and rotation back into mid-beta growth.

Thematic ETF Watch

- AI / Memory: Positive skew as SK Hynix (HBM) leadership and Samsung’s foundry optionality stay in focus. Any U.S. megacap AI capex updates remain a near-term driver.

- EV Value Chain: ASP pressure and inventory normalization keep a lid on rallies; sentiment tracks U.S./China EV headlines.

- China Exposure: Risk-off bias continues; prefer Korea-centric export baskets over China-sensitive themes for now.

- Dividend/Low-Vol: Gradual accumulation visible; offers ballast for multi-week positioning.

Foreign Investors Activity & Sentiment

- Flow posture: Foreigners were selective net buyers, concentrated in semiconductor and large-cap value baskets; KOSDAQ growth saw trimming.

- Hedging: Index hedges remain modest, consistent with a tactical risk-on environment rather than outright chase.

- FX: KRW stable-to-firm tone lowered vol and supported foreign demand for export-levered names.

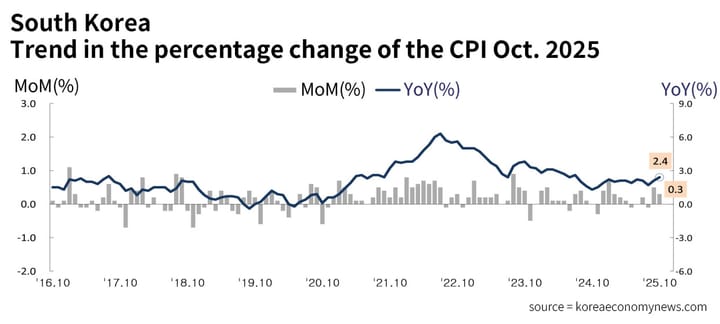

- Rates/Macro: With U.S. yields elevated but path uncertainty narrowing, the relative preference is quality growth over high-duration themes.

Tactical Positioning (1–2 Weeks)

- Overweight: Semiconductor baskets (e.g., KODEX Semiconductor – 091160) and core Korea broad beta (TIGER KOSPI 200 – 102110, EWY as U.S. proxy).

- Neutral/Core: Value/low-vol sleeves to dampen swings; consider dividend-tilted exposure.

- Underweight/Wait: EV/battery and China-sensitive themes until order visibility improves and margin pressure eases.

- Execution: Favor staggered adds on dips; maintain partial hedges given narrow breadth and event risk.

Risk Monitor

- Breadth risk: Leadership concentration remains high; watch for follow-through from financials/industrials.

- Macro tape bombs: U.S. labor/inflation prints; guidance from U.S. megacap AI buyers; China demand pulse.

- FX sensitivity: A sharp KRW reversal would challenge flows into export-levered ETFs.

- Positioning: If semis extend without breadth, risk-reward compresses; prefer buy-the-dip vs. chase-the-rip.

Quick Data Snapshot (directional, based on today’s tape)

- KOSPI baskets: flat to modestly higher

- KOSDAQ baskets: lower (growth de-risking)

- Semiconductor ETFs: up in the ~1–2% range

- EV/battery ETFs: down in the ~1–2% range

- Flows: inflows to semis/core; outflows from EV/China themes

Prepared by KoreaEconomyNews.com Research Team