Korea ETF Weekly – Jan 20–25, 2025 | Semiconductor Momentum Returns as Foreign Buyers Re-Enter

Korea ETFs advanced as semiconductor strength attracted selective foreign buying. EV battery themes lagged while market breadth remained narrow. Weekly institutional recap by KoreayEconomyNews.com.

Semiconductor Momentum Returns as Foreign Buyers Re-Enter

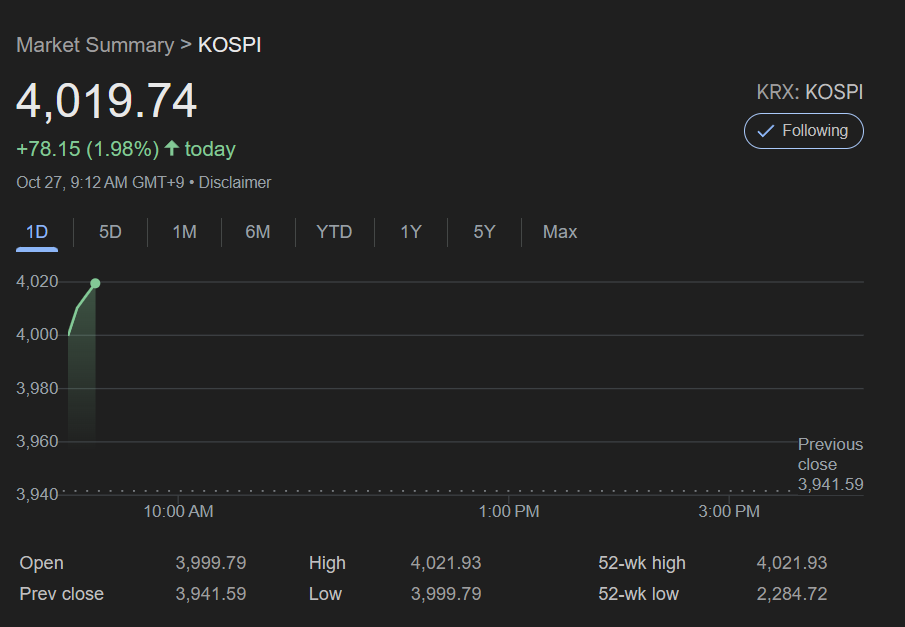

Momentum returned to the Korea equity market this week as foreign investors selectively rotated back into large-cap technology names, lifting semiconductor-linked ETFs and stabilizing broader market sentiment. Despite lingering macro uncertainty related to U.S. Federal Reserve rate expectations and China’s slower demand recovery, Korean risk assets showed signs of gradual accumulation rather than liquidation, marking a shift from the defensive tone observed earlier this month.

The KOSPI advanced modestly, supported by renewed strength in Samsung Electronics and SK Hynix, while the KOSDAQ showed mixed direction as speculative growth sectors lost steam. Meanwhile, Korea ETF flows reflected a clear divergence—technology and value-weighted large-cap ETFs attracted foreign buying interest, while thematic ETFs tied to EV batteries and secondary growth plays continued to lag.

Investor sentiment improved as market volatility eased and institutional positioning turned cautiously constructive, hinting at a tactical risk-on move rather than full-scale bullish conviction. Still, macro-sensitive sectors remained under pressure, suggesting that the recent rebound is selective and data-dependent rather than broad-based.

Key Takeaways (Weekly Summary)

- Semiconductor momentum returned as foreign inflows supported large-cap tech ETFs linked to Samsung Electronics and SK Hynix.

- EV battery and secondary tech themes showed relative weakness amid reduced speculative trading.

- Market tone improved from risk-off to cautiously risk-on, but breadth remains narrow.

- Foreign investors turned selective net buyers, favoring value-weighted and export-driven ETFs.

- Macro risks remain, including a still-strong USD/KRW bias and delayed U.S. Fed rate pivot expectations.

Top Performing Korea ETFs (Weekly)

| Rank | ETF Name | Ticker | Weekly Trend |

|---|---|---|---|

| 1 | KODEX Semiconductor | 091160 | ▲ Gained in 2% range |

| 2 | TIGER KOSPI 200 | 102110 | ▲ Modest rebound |

| 3 | KODEX MSCI Korea | 152280 | ▲ Large-cap support |

| 4 | TIGER Value Plus | 210780 | ▲ Value rotation |

| 5 | HANARO KRX 300 | 304940 | ▲ Broad market stability |

| Rank | ETF Name | Ticker | Weekly Trend |

|---|---|---|---|

| 1 | KODEX Secondary Battery | 305720 | ▼ Declined inside 1–2% range |

| 2 | TIGER China Electric Vehicle | 371460 | ▼ Weak China sentiment |

| 3 | KODEX KOSDAQ 150 | 229200 | ▼ Growth easing |

| 4 | TIGER Game Industry | 311390 | ▼ Weak risk appetite |

| 5 | ARIRANG K-New Deal | 269370 | ▼ Thematic sentiment muted |

Sector & Theme Rotation – Momentum Turning Selective

Sector rotation in the Korea equity market this week reflected defensive-to-tech repositioning, led by renewed buying in semiconductors, while EV battery, internet/theme, and China-linked sectors lagged. Capital rotation suggests that investors are favoring cash-flow visibility and export leverage rather than high-duration growth themes.

| Sector / Theme | Weekly Trend | Market Insight |

|---|---|---|

| Semiconductors | ▲ Strength | Beneficiary of global AI demand; aligns with U.S. SOXX & SMH rebound |

| Value / Large Cap | ▲ Stable inflows | Institutional tilt toward low-volatility equity |

| Banking & Financials | ↔ Neutral | Earnings-driven; awaiting macro catalysts |

| Internet / Platform | ± Mixed | Limited conviction buying; range-bound sentiment |

| EV & Battery | ▼ Weak | Supply chain uncertainty persists; Tesla sentiment weighs globally |

| Biotech / Healthcare | ▼ Soft | Speculative trading fades; no strong catalysts |

| China Exposure ETFs | ▼ Risk-off | Cross-border sentiment fragile |

Foreign Investor Flow & Market Sentiment

Foreign investors turned selective net buyers, concentrating on large-cap technology and value-weighted broad market ETFs. Cash equity and futures positioning indicate risk-on but hedged exposure: investors added to semiconductor bellwethers while keeping index hedges modestly in place. This is consistent with the reacceleration in AI-related capex globally and improving visibility for memory pricing into 1H25.

On FX, KRW traded with a mild stabilization bias, helping reduce equity volatility and improving foreign buying appetite for export-oriented names. U.S. yields remained elevated but rate path uncertainty narrowed, which historically favors quality growth over high-duration speculative themes. ETF-level prints echoed this: semiconductor and value baskets saw inflows, while EV battery and thematic growth experienced light outflows.

Market breadth improved from earlier in the month but remains narrow, with leadership concentrated in semiconductors, hardware, and select financials. Sentiment moved from defensive to cautiously constructive: a shift driven less by macro relief and more by company-level earnings visibility—namely SK Hynix’s HBM leadership and Samsung’s foundry/memory upcycle optionality.

Outlook, Strategy, and Conclusion

Outlook (Next 1–3 Weeks)

- Base case: Korea ETFs grind higher led by semiconductors; pullbacks likely bought as long as USD/KRW remains contained and U.S. yields don’t spike.

- Watchlist: U.S. data (labor, inflation), AI server build schedules, and China demand pulse for cyclical confirmation.

- Breadth risk: Rally leadership is still concentrated; a durable extension needs financials/industrials participation.

Strategy – ETF Positioning (Tactical)

- Overweight: Semiconductor & large-cap tech ETFs (e.g., KODEX Semiconductor (091160); U.S. comps SOXX/SMH show similar leadership).

- Core Hold: Broad Korea exposure via TIGER KOSPI 200 (102110) or iShares MSCI South Korea – EWY; use dips to add.

- Underweight / Wait: EV battery & high-duration themes until margins stabilize and global EV order signals firm up.

- Risk Controls: Maintain partial index hedges or staggered entries given narrow breadth and event risk.

Conclusion

Foreign investors re-engaged with Korea through semiconductor-led ETFs, shifting the tone from risk-off to selectively risk-on. With FX stability, earnings visibility in chips, and global AI demand acting as pillars, Korea’s ETF complex appears tactically attractive—provided investors respect breadth fragility and macro event risks.

Report by KoreayEconomyNews.com Research Team