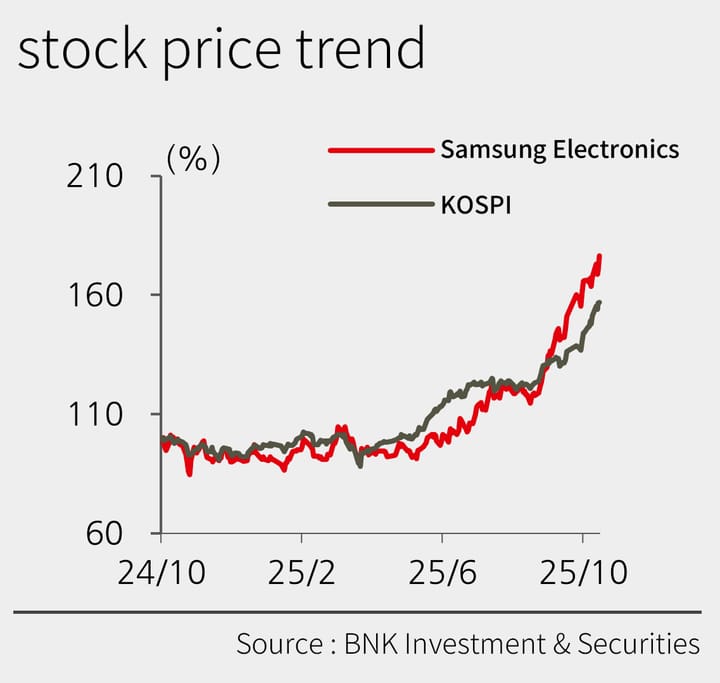

Korea Market Closes Higher for Sixth Straight Session on Tech Rally; Short-Selling Volume Eases

Korean equities advanced as institutional inflows offset foreign selling, and easing short-selling activity signaled improving risk sentiment.

Institutional buying offsets foreign selling pressure; KOSDAQ rebounds as tech leads

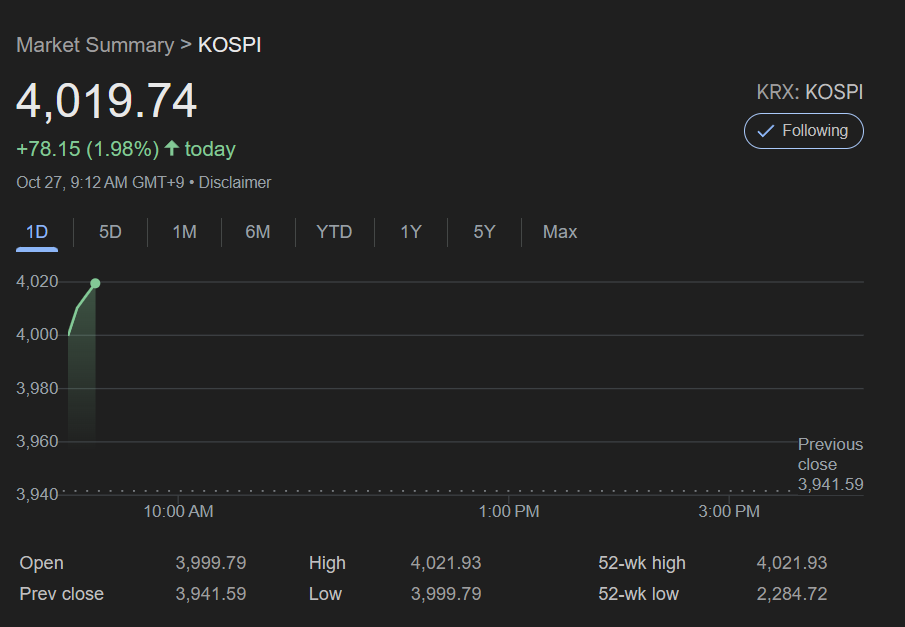

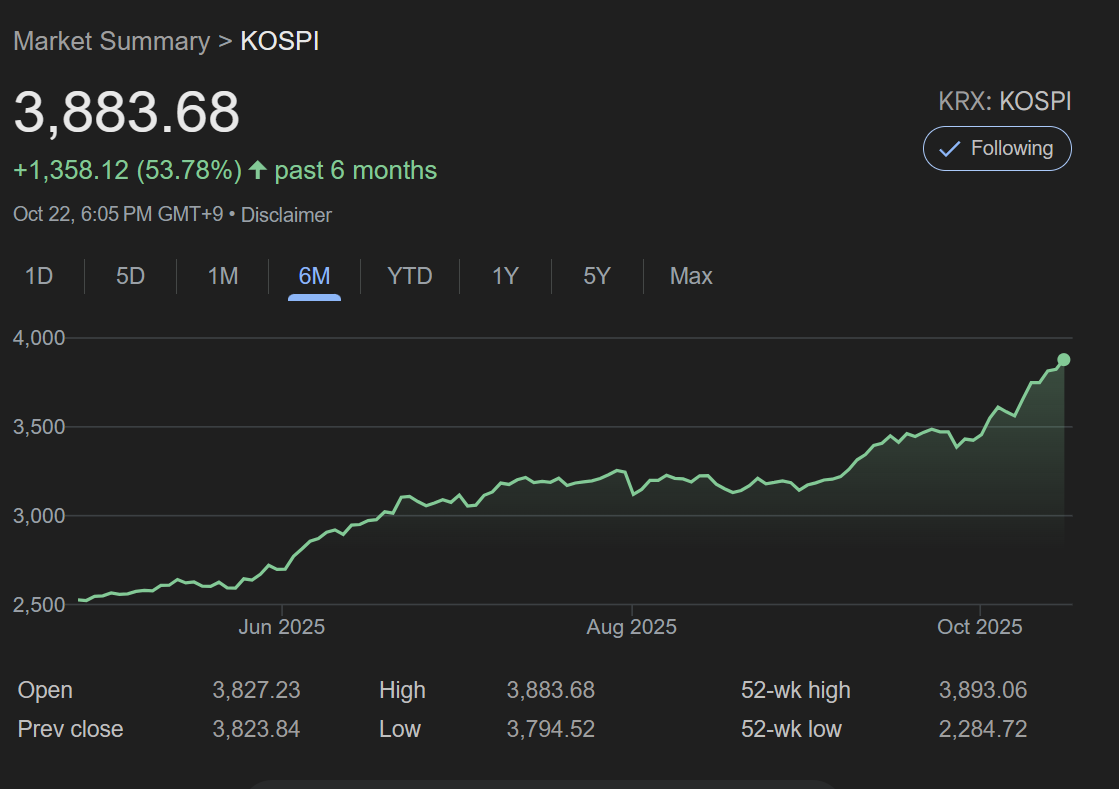

South Korean equities extended their winning streak on Wednesday, with the KOSPI closing higher for the sixth consecutive session as institutional buying in large-cap technology stocks outweighed foreign selling pressure. The KOSDAQ also rebounded after a one-day decline, supported by gains in secondary battery shares.

The KOSPI climbed 1.56% to close at 3,883.68, while the KOSDAQ added 0.76% to finish at 879.15. Total trading value reached KRW 15.1 trillion on the KOSPI and KRW 8.3 trillion on the KOSDAQ.

Kospi/Kosdaq Closing market situation 251022

Tech-Led Rally Drives Market Gains

The KOSPI opened flat amid renewed caution over U.S.–China trade tensions but gained momentum throughout the session as institutional investors shifted to net buying, led by electronics and automotive sectors. The chemical (+4.4%), automotive & parts (+3.7%), and transportation (+3.1%) sectors posted strong gains, signaling broader market strength.

Institutional investors bought a net KRW 7,624 billion in equities, offsetting foreign net selling of KRW 7,227 billion. Electrical and electronics stocks saw the largest foreign outflows.

A Seoul-based strategist noted, “Despite foreign selling, domestic institutional support—particularly in semiconductor and chemical names—continues to underpin market momentum.”

KOSDAQ Supported by Secondary Battery Stocks

Despite overnight weakness on the Nasdaq, the KOSDAQ ended higher, led by financials (+8.6%) and paper & wood (+2.6%) sectors. Individual investors remained strong net buyers, absorbing institutional and foreign sell-offs.

Short Selling Activity Moderates

Short-selling activity showed a decline in overall market pressure. As of October 20, total short-selling turnover stood at KRW 1.073 trillion, down KRW 216.6 billion from the previous session. The short-selling ratio accounted for 3.17% of total trading value.

251020공매도데일리브리프

| Market | Short-Selling Turnover | Short-Selling Share |

|---|---|---|

| KOSPI | KRW 862.6 billion | 4.01% |

| KOSDAQ | KRW 210.4 billion | 1.71% |

Foreign investors remained dominant in short-selling, accounting for 62.68% of KOSPI short trades and 76.14% on KOSDAQ.

251020 Short Selling Daily Brief

Top short-sold KOSPI stocks included SK hynix, Samsung Electronics, Hyundai Motor, LG Energy Solution, and Naver, while EcoPro BM, Alteogen, and EcoPro led on the KOSDAQ.

251020공매도데일리브리프

Currency & Global Market Snapshot

The Korean won strengthened against the U.S. dollar, closing at KRW 1,430.2, while crude oil prices recovered with WTI rising 0.52% to $57.82 per barrel.

Closing market report 251022

Global markets were mixed:

- Dow Jones +0.5%

- Nasdaq –0.2%

- Germany DAX +0.3%

- Hong Kong HSI –0.9%

마감시황251022

Outlook

Analysts expect short-term volatility ahead of major U.S. tech earnings but note that domestic liquidity and institutional participation continue to support Korean equities. Market attention now shifts to third-quarter earnings from major exporters and policy signals from the Bank of South Korea.