Korea Market Closing – KOSPI Breaks Above 4,000 for First Time Ever; Samsung Electronics Tops ₩100,000

Korea Stocks Soar as Foreign and Institutional Buying Drives Broad-Based Rally Tech and shipbuilders jump; policy and earnings optimism lift risk appetite.

Market Highlights

- KOSPI closes at 4,042 (+2.57%) — first-ever close above the 4,000 mark

- KOSDAQ ends at 902 (+2.22%), aided by tech and secondary battery names

- Foreign investors buy ₩6.48tn on KOSPI; institutions also net buyers; individuals take profits

- Samsung Electronics tops ₩100,000 for the first time, fueling index gains

- Shipbuilding stocks surge on potential APEC-related diplomacy and U.S.–Korea headlines

- Risk-on tone supported by U.S.–China summit progress, Fed rate-cut hopes, and earnings momentum

The Seoul market finished sharply higher on Monday, extending a powerful rebound across Asia as foreign and institutional inflows accelerated. The KOSPI gained 2.57% to 4,042, while the KOSDAQ advanced 2.22% to 902, with technology and shipbuilding leading the move. Sentiment improved on signs of progress ahead of a U.S.–China leaders’ meeting, expectations for monetary easing after a softer U.S. CPI print, and optimism around ongoing corporate results.

Large-cap bellwethers led: Samsung Electronics (KRX:005930) pushed through ₩100,000 for the first time, energizing the broader technology complex, while enthusiasm for potential APEC-related diplomacy and high-profile visits drove shipbuilding shares higher.

Investor Flows (KRW bn)

| Investor Type | KOSPI | KOSDAQ |

|---|---|---|

| Individuals | −7,945 | −2,943 |

| Foreigners | +6,478 | +2,392 |

| Institutions | +2,341 | +578 |

Foreign buying concentrated in large-cap technology and cyclicals, while institutions added exposure into strength. Retail investors realized gains following the record-setting move.

Stock Movers (indicative)

| Group | Names | Note |

|---|---|---|

| Semiconductors | Samsung Electronics (KRX:005930), SK Hynix (KRX:000660) | Chip earnings momentum, improving demand outlook |

| Shipbuilding | HD Hyundai Heavy Industries, Hanwha Ocean, Samsung Heavy Industries | APEC-related headlines, potential high-level visits |

| Brokers | Major securities houses | Index at record territory, higher turnover supportive |

| Entertainment | Leading K-content names | Speculation on easing of China content restrictions |

(No percent changes shown to avoid overprecision without official prints.)

What’s Driving the Market

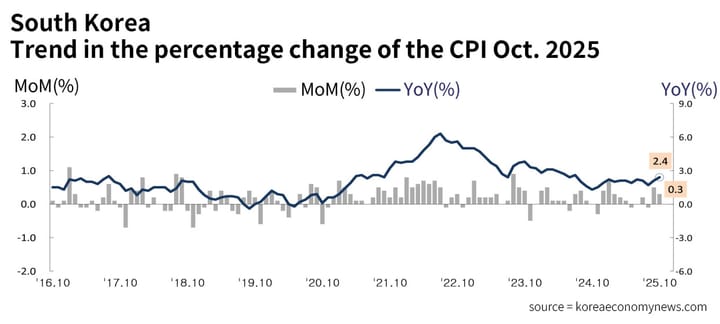

- Macro & Policy: Reports of U.S.–China progress ahead of a leaders’ meeting boosted risk appetite. A softer-than-expected U.S. CPI reinforced rate-cut hopes at the Fed.

- APEC Optics: High-profile diplomatic activity—alongside speculation about overseas dignitaries touring Korean shipyards—supported a sharp rotation into shipbuilding.

- Earnings Pulse: Resilient tech sentiment—helped by recent semiconductor earnings beats—lifted Korea’s heavyweight names, underpinning the index breakout.

- Flows & Positioning: Strong foreign and institutional demand met with retail profit-taking, a classic profile during record-setting sessions.

Market Outlook

With the KOSPI now above a major psychological threshold, near-term direction will hinge on:

- Outcomes from APEC and any tangible signals on U.S.–China trade/technology frictions;

- FOMC communications and global inflation trajectory;

- Mega-cap results this week (incl. SK Hynix, alongside U.S. tech peers).

If semiconductor momentum persists and KRW stability continues, strategists say the index could attempt to consolidate above 4,000, though headline risk from global policy and earnings guidance may inject two-way volatility.