Korea Market Closing – KOSPI Retreats After Record Run : KOSDAQ Extends Gains

Seoul stocks ended mixed Tuesday as foreign investors reduced positions ahead of major policy events and semiconductor earnings.

Oct 27, 2025 | Seoul

Market Highlights

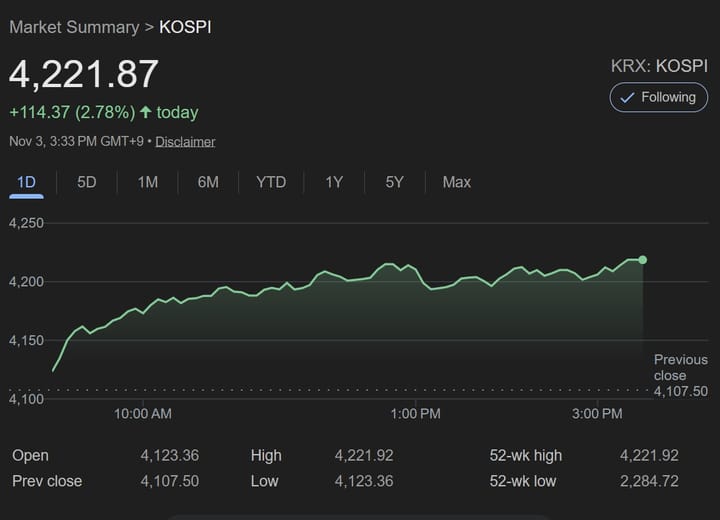

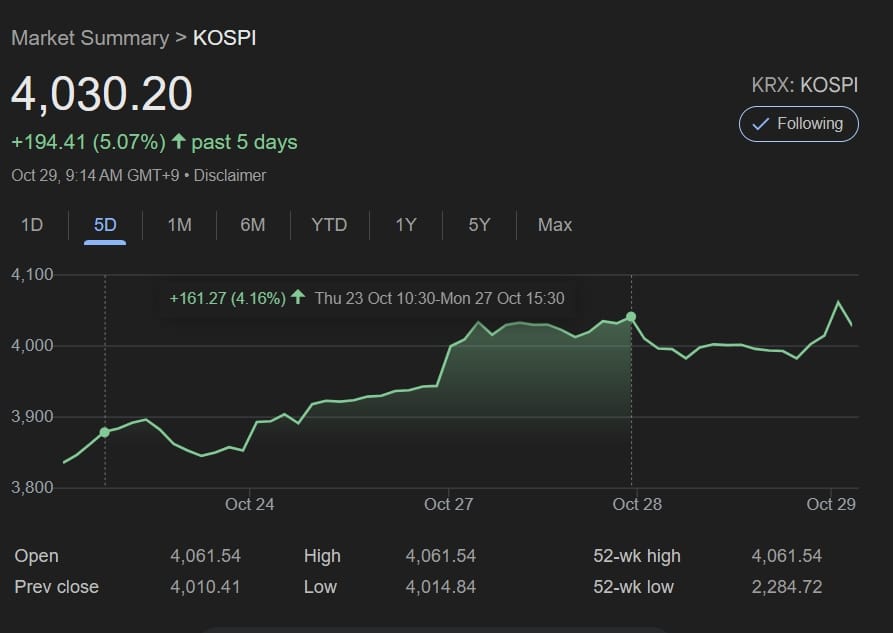

- KOSPI closes at 4,010.41 (–0.80%) after three-session rally

- KOSDAQ rises slightly to 903.30 (+0.07%), third straight gain

- Foreign investors sell ₩16.4 trillion in the KOSPI cash market

- Electronics and auto stocks weaken on profit-taking

- Construction and financials support KOSDAQ strength

- Risk sentiment turns cautious ahead of APEC diplomacy and U.S.–Korea talks

The Korean equity market paused on Tuesday as foreign investors locked in profits following a strong rally that pushed the KOSPI above 4,000 earlier this week. The benchmark KOSPI slipped 0.80% to close at 4,010.41, while the KOSDAQ finished marginally higher at 903.30 (+0.07%), supported by selective buying in construction and financial names.

The session reflected a cautious stance from traders ahead of multiple market catalysts, including the upcoming Korea–U.S. summit, APEC discussions, and SK Hynix earnings later this week.

Investor Flows (KRW billions)

| Investor Type | KOSPI | KOSDAQ |

|---|---|---|

| Foreigners | −16,410 | −1,561 |

| Institutions | +924 | +254 |

| Individuals | +15,734 | +1,497 |

Foreign funds turned to large-scale net selling in Korean equities, led by profit-taking in electronics (−₩12.8T) and transportation equipment (−₩3.56T). Institutions and retail investors bought the dip.

Source: KRX Market Brief

마감시황251028

Sector Performance

| KOSPI Sectors | Performance |

|---|---|

| Transportation Equipment | −2.3% |

| Retail | −1.7% |

| Electronics | −1.2% |

| Financials | −1.0% |

| KOSDAQ Sectors | Performance |

|---|---|

| Construction | +3.9% |

| Financials | +2.1% |

| Other Manufacturing | +2.1% |

Ticker Highlights (KRX)

- Samsung Electronics (KRX:005930) – Pulled lower by broad foreign selling in tech

- SK Hynix (KRX:000660) – Traders cautious ahead of earnings this week

- Hyundai Motor (KRX:005380) – Auto sector declines on foreign outflows

- POSCO Holdings (KRX:005490) – Market rotation weighs on cyclical names

- L&F / EcoPro BM – Secondary battery momentum supports KOSDAQ resilience

Global Market Context

Asian trading sentiment was mixed as markets awaited macro direction from upcoming APEC geopolitical developments and U.S. Federal Reserve guidance. U.S. equities advanced overnight with the Dow rising 0.7% and the Nasdaq 1.9%, while the Nikkei slipped 0.6% amid regional consolidation.

Market Outlook

Analysts expect short-term volatility as investors monitor policy signals and earnings:

“Foreign flows may remain defensive until clarity emerges from upcoming summit diplomacy and Fed messaging,” said one Seoul strategist.

Market attention will focus on SK Hynix earnings, APEC trade commentary, and any policy signals related to technology exports and supply chains.

For more analysis, visit our Markets Section.

By Korea Economy News Market Desk | Seoul

Sources: KRX, Market Strategy Data