Korea’s Auto Sector Rises on U.S. Tariff Cut to 15%; Hyundai, Kia to Gain Billions

SK Securities projects a sharp earnings upside for Hyundai Motor and Kia as the U.S. slashes import tariffs on Korean vehicles to 15%, cutting costs and widening room for shareholder returns.

- SK Securities sees Korea’s auto exports entering a “15% tariff era” following U.S.–Korea trade talks.

- Lower duties could boost Hyundai and Kia’s 2026 earnings by nearly ₩4 trillion combined.

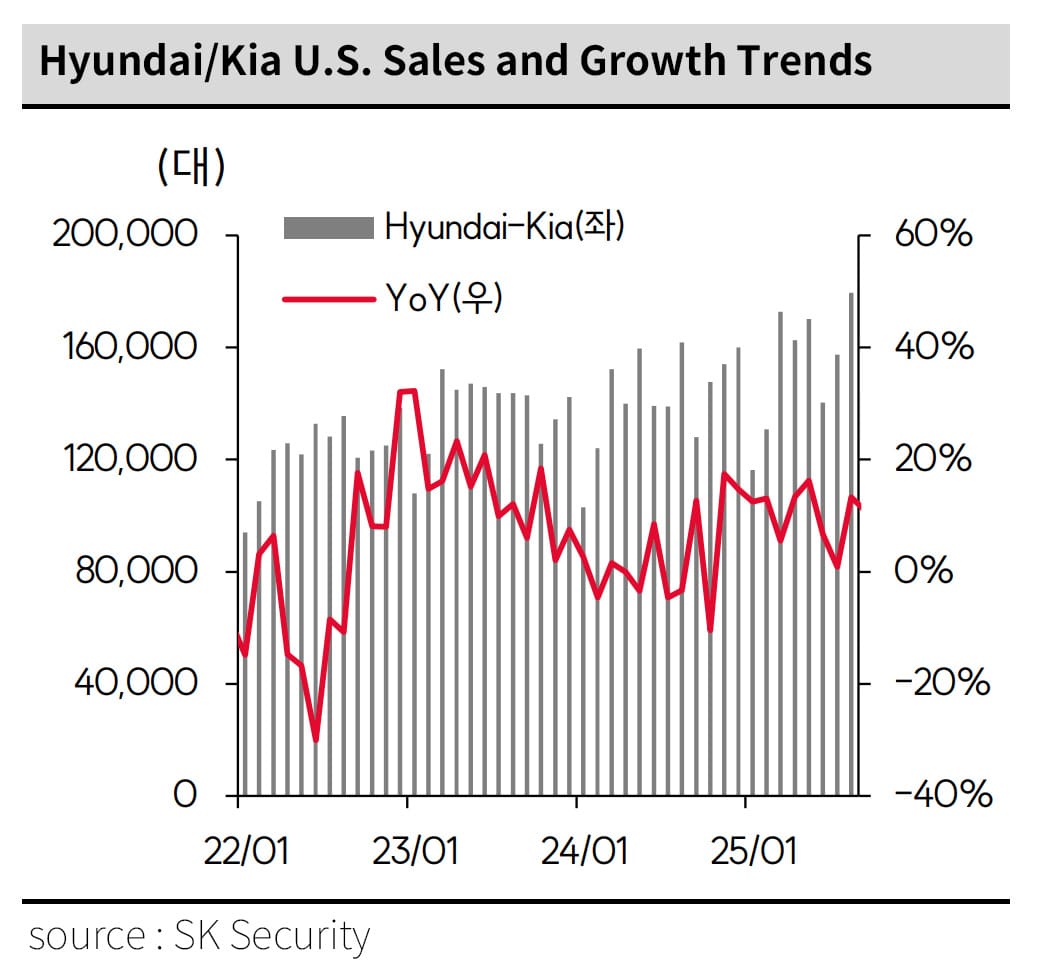

- U.S. market share for Korean brands expected to hit record highs as weaker rivals struggle.

- Share buybacks and dividend payouts likely to expand amid stronger profitability.

SK Securities said Thursday that Korea’s automobile sector is entering a “15% tariff era” following trade adjustments announced after former U.S. President Donald Trump’s visit to Seoul. The brokerage argued that reduced tariffs on Korean-made vehicles will mark a structural turning point for Hyundai Motor Group and the broader Korean automotive industry.

According to the report, a 15% U.S. import tariff—down from 25%—will slash tariff-related expenses by 25% in Q4 2025 and increase 2026 earnings per share (EPS) by around 20%. SK Securities estimated the tariff savings at ₩3.4 trillion for Hyundai and ₩2.5 trillion for Kia, equivalent to ₩11.2 trillion and ₩8.4 trillion in potential market capitalization gains when applying a PER multiple of 5.

Operating profits for 2026 could reach ₩13.3 trillion for Hyundai and ₩11.1 trillion for Kia, compared with ₩11.0 trillion and ₩9.4 trillion under the previous 25% tariff scenario.

The report highlighted strong potential for increased U.S. market share as Korean automakers maintain pricing discipline while competitors face profitability pressure. “Automakers with weaker financial health—such as Nissan, Stellantis, Ford, and Honda—are expected to raise prices by 1H 2026,” SK Securities wrote, noting that Hyundai Motor Group’s U.S. market share already hit an all-time high of 12% and is poised to rise further.

Meanwhile, the firm expects Hyundai to allocate roughly ₩600 billion and Kia ₩700 billion to share buybacks as profits expand, enhancing shareholder returns through 2025–2026. “Announcements on additional buyback programs are likely by year-end or early next year,” the report stated.

Risks remain subdued, SK Securities added, citing that the recent decline in Q3 2025 operating profits (Hyundai ₩2.6 trillion, Kia ₩2.0 trillion) has already been priced into shares.

The firm also pointed to China’s growing car exports to Europe and South America, and ongoing delays in global autonomous driving adoption due to regulatory hurdles, as mid- to long-term concerns.

Follow Korea Economy News for more in-depth market reports and trade policy analysis.