KOSPI Breaks 4,000 for the First Time; Tech and Defense Lead Rally as Market Eyes Mid-Term Revaluation

The KOSPI index surpassed 4,000 points for the first time in history, driven by strong gains in semiconductor and defense stocks. Foreign and retail investors supported the rally amid easing macro risks and improved global sentiment.

South Korea’s benchmark index KOSPI surpassed the 4,000-point mark for the first time in history on the 27th, marking a major milestone in the domestic stock market. The index opened at 3,999.79, up 1.48% (+58.20 points) from the previous session, and continued to gain momentum before briefly touching an all-time intraday high of 4,029.44. As of 9:24 a.m., the KOSPI was trading at 4,021.16 (+2.02%), solidly above the 4,000 threshold.

This breakthrough comes just four months after the index crossed the 3,000 mark on June 20, accelerating expectations that the long-discussed “Kospi 5,000” era may now begin in earnest.

Strong Buy Flows from Retail and Foreign Investors

In the Korea Exchange, retail investors net bought ₩6.1 billion, while foreign investors purchased ₩134.9 billion. Institutional investors, on the other hand, recorded a net selling volume of ₩138.5 billion. In the KOSPI 200 futures market, foreign investors showed a contrasting stance with ₩291.5 billion in net selling, signaling cautious positioning despite the index rally.

Meanwhile, in the Seoul foreign exchange market, the Korean won opened at 1,436.7 KRW per USD, down 0.4 KRW from the previous session, reflecting modest strength in the local currency.

U.S. CPI Surprise and Summit Diplomacy Drive Momentum

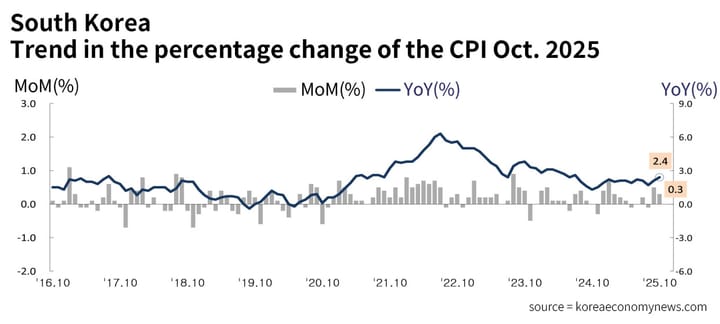

Global market sentiment turned risk-on after the latest U.S. September Consumer Price Index (CPI) rose less than expected, fueling renewed hopes for Federal Reserve interest rate cuts. All three major U.S. indices rallied to record highs at the end of last week.

Additionally, geopolitical developments supported investor sentiment. With summit talks scheduled between the U.S. and China, as well as between South Korea and the United States, markets bet on easing trade tensions and improved diplomatic cooperation.

- U.S.–China Summit: President Donald Trump and President Xi Jinping are expected to meet during the APEC Summit on the 30th, raising hopes of a breakthrough in the prolonged trade dispute.

- Rare Earth Relief: U.S. Treasury Secretary Scott Besant signaled progress, noting that China is likely to delay its rare-earth export controls by one year, while the U.S. is expected to hold off on the proposed 100% additional tariffs.

- U.S.–Korea Trade Talks: Scheduled for the 29th, this summit may finalize follow-up agreements on bilateral tariff adjustments, previously stalled since July.

Market Leaders: Tech and Defense Surge

Large-cap technology stocks led the rally:

| Stock | Performance |

|---|---|

| Samsung Electronics | +3.04% – Surpasses ₩100,000 per share for the first time |

| SK hynix | +4.61% – Breaks into mid ₩530,000 range |

| LG Energy Solution | +1.12% |

| Samsung Biologics | +1.87% |

| HD Hyundai Heavy Industries | +4.21% |

| Hanwha Aerospace | +1.18% |

On the downside, NAVER (-1.01%) and Samsung Life Insurance (-0.37%) saw minor corrections.

Sector Trends

- Gainers: Construction (+4.45%), Electronics (+3.12%), Securities (+2.82%)

- Decliners: Steel & Materials (-1.54%), Food & Beverages (-0.41%)

The KOSDAQ also traded higher, gaining 1.37% (+12.09 points) to 895.17.