Samsung Electronics Q3 Earnings Fueled by Memory Recovery; BNK Lifts Target to ₩130,000

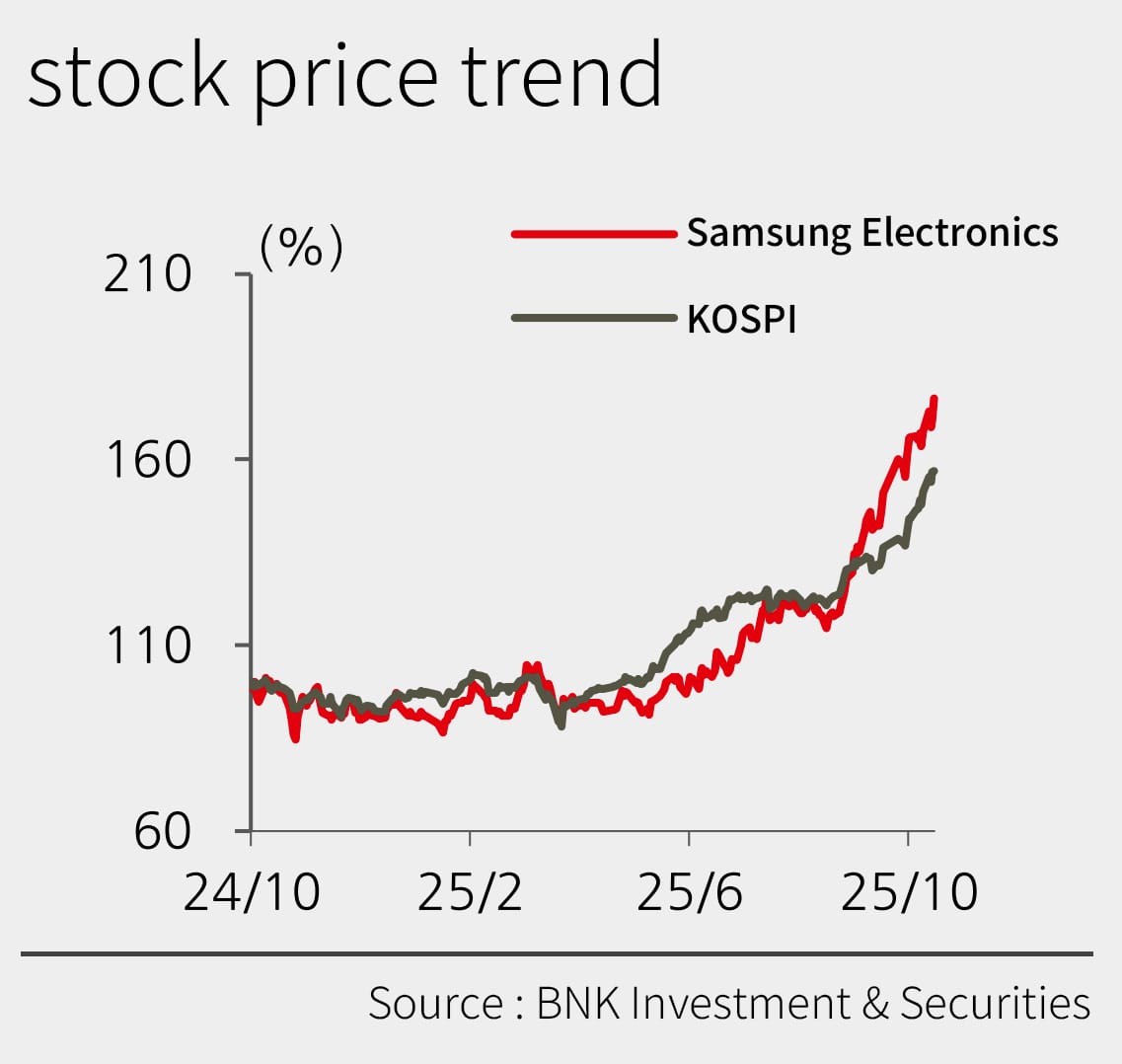

BNK Investment & Securities raised its target price for Samsung Electronics to ₩130,000, citing strong semiconductor recovery despite weakness in the VD division.

- BNK Investment & Securities cites semiconductor-driven rebound led by DRAM and NAND.

- Memory margins surged on stronger server demand and price hikes.

- VD division slipped into losses amid fierce competition.

- Target price raised to ₩130,000; “Buy” rating maintained.

BNK Investment & Securities reported that Samsung Electronics’ third-quarter earnings improved significantly on the back of a strong rebound in its semiconductor business, even as its VD division underperformed.

The semiconductor (DS) division was the key growth driver, supported by the removal of one-off expenses and robust demand for server DRAM and HBM3E chips. DRAM operating margin surged to 41%, up 17 percentage points quarter-on-quarter, while NAND profitability turned positive with a 6% margin thanks to higher eSSD demand and rising prices.

System LSI losses narrowed sharply to about ₩0.8 trillion due to higher utilization and cost optimization.

In contrast, the DX division posted mixed results: the MX business saw strong Galaxy S25 and Z Fold7 sales, but VD recorded an operating loss amid intensifying competition.

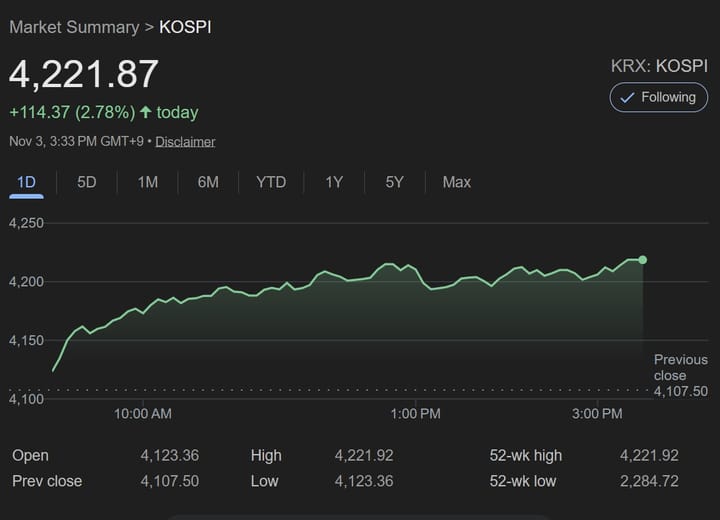

For Q4 2025, BNK forecasts an operating profit of ₩13.7 trillion (DS ₩9.5 trillion, SDC ₩1.2 trillion, DX ₩2.5 trillion, Harman ₩0.5 trillion), with memory profits expected to reach ₩10.2 trillion — up ₩3 trillion quarter-on-quarter.

DRAM and NAND bit growth are projected at 3% and -10% QoQ, respectively, while ASPs are seen rising 15% and 12%, driving further margin expansion.

Non-memory businesses, including LSI and Foundry, are likely to remain in deficit due to limited sales recovery.

BNK maintained its “Buy” recommendation and raised its target price to ₩130,000, applying a P/B multiple of 1.9x and forward P/E of 14.8x.

The brokerage added that memory market conditions remain favorable to suppliers, with hyperscalers’ demand for 2026 outpacing the cautious capacity expansion from producers — a situation that could extend supply shortages.

Despite the recent rally, BNK noted Samsung’s valuation still trades below historical peaks, leaving room for further upside.