Samsung Stock Hits Record High Above ₩100,000 on AI Momentum and Buybacks

Samsung Electronics broke through ₩100,000 for the first time as market cap neared ₩600 trillion, driven by AI memory momentum, strategic deals and buybacks.

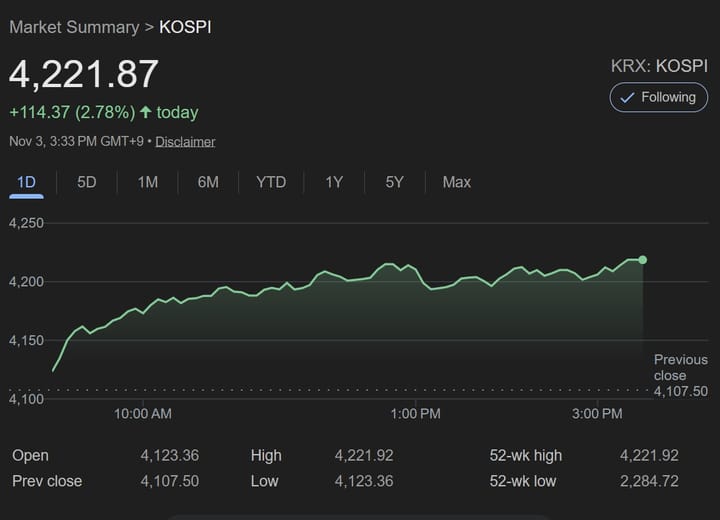

Samsung Electronics (KRX: 005930) surged to a historic milestone as its share price broke through the ₩100,000 level for the first time ever, marking a symbolic moment not only for Korea’s equity market but for the global semiconductor landscape. The stock opened sharply higher and extended gains amid strong institutional and retail demand, lifting the company’s market capitalization to approximately ₩597 trillion — firmly solidifying Samsung’s position as Asia’s most valuable semiconductor company.

The rally was fueled by a powerful combination of AI-driven semiconductor demand, a rebound in profitability, and aggressive shareholder return initiatives including large-scale share buybacks. Improving investor sentiment surrounding Korea’s flagship stock was also supported by renewed confidence in its high-bandwidth memory (HBM) competitiveness, a critical technology powering next-generation AI data centers and large language model (LLM) training infrastructure.

Historic Milestone for Korea’s Largest Stock

Samsung’s rise above the psychologically significant ₩100,000 barrier marks the culmination of a steep recovery from last year’s cyclical downturn in memory semiconductors. After hitting a low near ₩49,900, the stock has now more than doubled in less than a year, outperforming both the KOSPI benchmark and several global chip peers in recent months. Market participants interpreted the price action as a sentiment inflection, signaling that international investors may now be re-rating Korean mega-cap technology exposure amid accelerating AI infrastructure demand worldwide.

“This rally reflects not a speculative run, but a structural earnings re-rating tied to AI memory demand and Samsung’s strategic pivot,” said one Seoul-based equity strategist.

Semiconductor Business Rebounds After Difficult Cycle

Just one year ago, Samsung faced its deepest semiconductor downturn in over a decade and temporarily lost its No.1 global DRAM market share to SK hynix—the first time in 33 years. Profit from its Device Solutions division collapsed, dragging down overall earnings. The turning point came as an AI server upcycle took hold. In the third quarter, Samsung delivered ₩12.1 trillion in operating profit (+31.8% YoY) with record revenue of ₩86 trillion, signaling a return to double-digit trillion profitability.

The earnings rebound is tied less to consumer electronics and more to enterprise AI infrastructure: hyperscale data centers are ramping GPU clusters; HBM remains tight; and memory ASPs have recovered from cyclical lows. Samsung is narrowing the HBM gap with SK hynix while accelerating HBM3E and HBM4 development—key for next-generation AI accelerators. Foundry operations are also stabilizing, with automotive and AI wins expanding the pipeline.

AI Alliances and Mega Partnerships Fuel Growth Outlook

After legal uncertainties were resolved mid-year, Chairman Lee Jae-yong (Jay Y. Lee) accelerated Samsung’s deal-making across the global tech ecosystem. Key milestones include a reported ₩23 trillion Tesla foundry agreement, an Apple supply deal for next-generation image sensors, and participation in OpenAI’s “Stargate” AI supercluster initiative. Market observers see these not as one-off wins but as signals that Samsung is positioning itself as a core enabler of global AI compute power. Reports also indicate HBM3E qualification with NVIDIA is in the final stage, with HBM4 on the roadmap.

Buybacks, Governance Signals, and the Psychology of ₩100,000

Management’s ₩10 trillion buyback and insider purchases helped reset sentiment when memory pricing was bottoming, strengthening the case for earnings normalization and capital discipline. Crossing ₩100,000 creates a new anchor level: passive flows have more headroom to scale, and momentum strategies tend to respect breakout zones if the newsflow stays positive.

What changed: (1) The profit cycle improved; (2) strategic deals expanded medium-term earnings visibility; (3) capital return re-opened foreign sponsorship.

Risks: High expectations, sensitivity to AI capex cadence, HBM yields, and KRW direction; rapid gains raise the bar for execution.

Outlook

- Base case: Sideways-to-higher as AI memory newsflow and foundry traction persist.

- Catalysts: HBM3E/HBM4 updates, large-customer qualifications, incremental AI infrastructure partnerships.

- Watch: Yield/defect rates, KRW path, and guidance from U.S. megacaps on data center capex.

Bottom line: Samsung’s break above ₩100,000 reflects a multi-engine story—AI memory, foundry opportunities, and disciplined capital return. If execution continues to track, the new trading range may prove durable, with dips framed as opportunities rather than trend breaks.

Report by KoreaEconomyNews.com Research Team