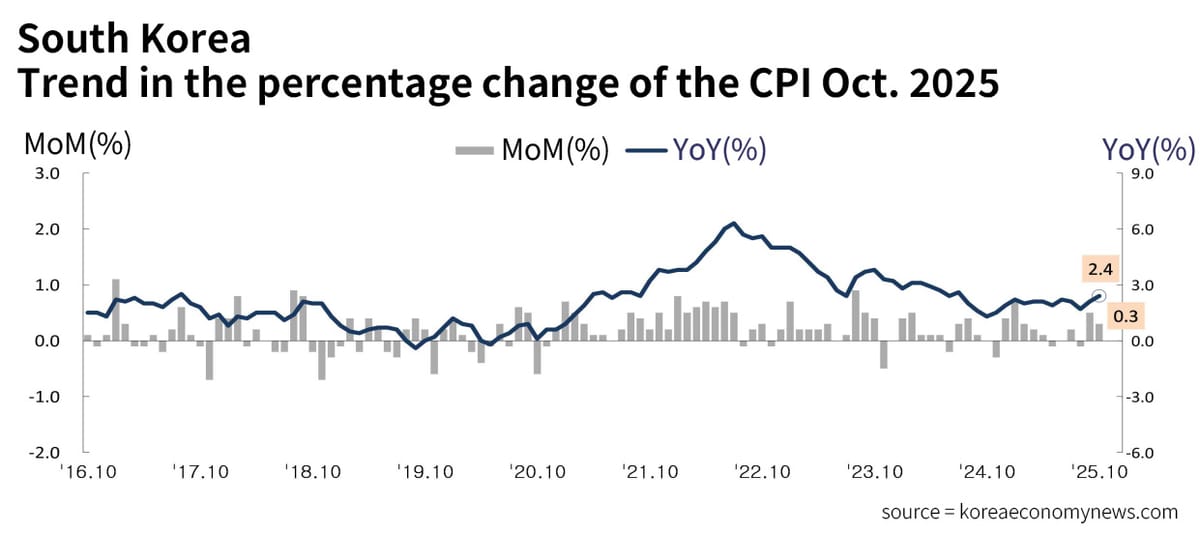

South Korea CPI - Inflation Slows to 2.4% in October as Fresh Food Prices Ease

South Korea’s consumer inflation eased to 2.4% in October, marking a second straight month of sub-3% price growth as food costs declined while energy and service prices stabilized.

- South Korea’s consumer inflation rose 2.4% YoY in October, slowing from 2.5% in September.

- Fresh food prices fell 0.8%, with vegetables down 14.1%, offsetting service price gains.

- Core inflation stood at 2.2%, signaling continued moderation.

- Economists expect inflation to remain in the mid-2% range through early 2026.

South Korea’s inflation rate slowed for the second straight month in October, as falling fresh food prices offset continued increases in service and industrial goods costs, according to data released Monday by Statistics Korea.

The Consumer Price Index (CPI) rose 2.4% year-on-year and 0.3% month-on-month, down slightly from September’s 2.5% annual gain.

Core inflation, excluding food and energy, increased 2.2%, while the index excluding agricultural and petroleum products rose 2.5%, indicating gradual stabilization in underlying price trends.

Price Breakdown

- Agricultural, livestock and fisheries products: +3.1% YoY — meat (+6.8%) and seafood (+6.2%) rose, but vegetables plunged (-14.1%).

- Industrial goods: +2.3% YoY — led by processed foods and household items.

- Electricity, gas and water: +0.4% YoY — stable following last year’s base effect.

- Services: +2.5% YoY — driven by dining (+3.6%) and personal care (+3.4%).

The living cost index climbed 2.5%, while the fresh food index dropped 0.8%, showing easing volatility in volatile food categories.

Housing-related costs, including rent and maintenance, edged up 1.8%, maintaining moderate upward pressure.

Economic Outlook

Analysts expect inflation to stay around the mid-2% range into early 2026.

The Bank of Korea is widely expected to keep its policy rate at 3.50%, maintaining a cautious stance as domestic consumption weakens.

A Statistics Korea official noted, “Food-price volatility is easing, but risks remain from global oil markets and weather-related supply issues.”