KOSPI's Fifth Bull Market Since 1975 : Historical Pattern Suggests Year-End Rally Ahead

The KOSPI is hitting historic highs, but this isn't just any ordinary record-breaking run. We're witnessing an exceptionally rare surge that ranks among the most powerful in market history.

The KOSPI has soared 42% year-to-date, marking the fifth major bull market in the index's 50-year history. More significantly, when excluding post-recession bounce-backs, this represents only the third genuine bull market of this magnitude.

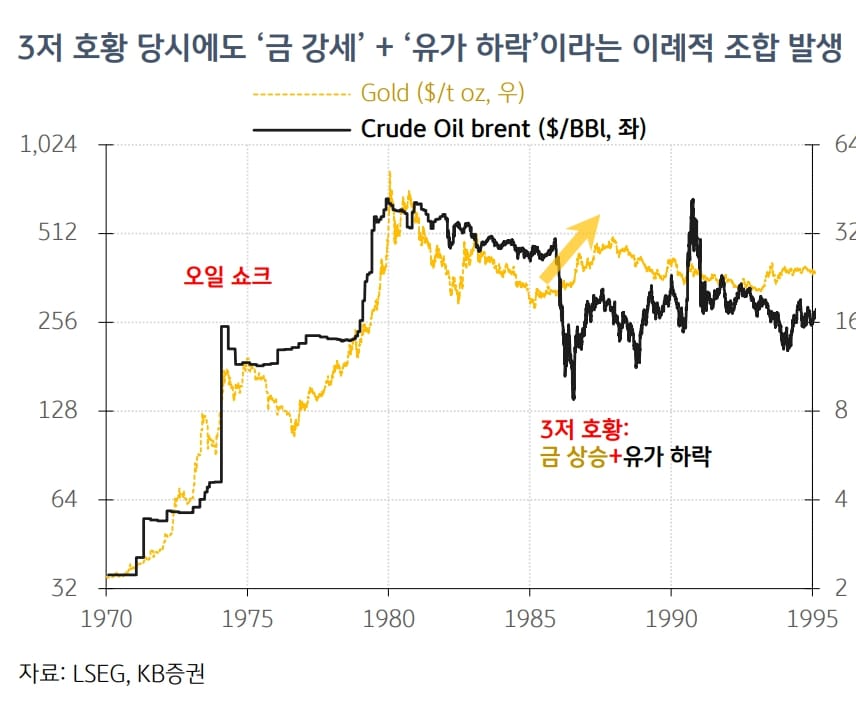

The periods that outperformed the current rally were all during "Three Lows" boom cycles. Previous analysis has highlighted how today's macro environment closely mirrors these historical "Three Lows" conditions, suggesting similar market dynamics could unfold. This means the rally isn't just driven by market stimulus policies—the underlying macro environment itself is fundamentally supportive.

Looking at historical precedent, markets have typically continued rising through year-end in similar circumstances. The success rate was approximately 90%, with average gains of +7.6% from current levels to year-end.

Key Takeaways:

- Unprecedented Bull Market: The KOSPI's +42% YTD surge is unmatched except during "Three Lows" boom periods. Remarkably, current conditions mirror those historical environments.

- Rare Macro Alignment: The combination of low currency/low oil/low rates is extraordinarily difficult to achieve simultaneously. This convergence is happening for the first time in 40 years since 1986.

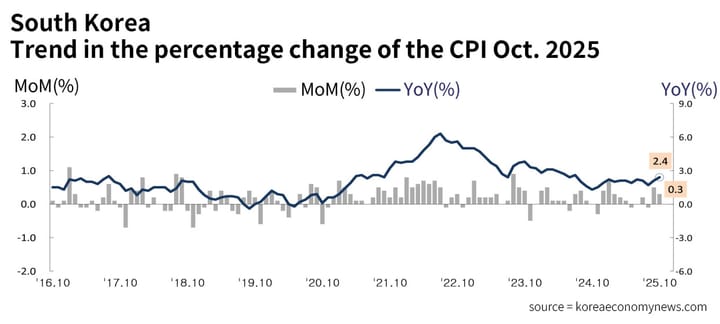

- Inflation Risk Timeline: The primary factor that could trigger a bear market (-20% range) would be inflation. However, serious inflation concerns aren't expected until the second half of next year.

The "Three Lows" Environment Continues

The "Three Lows" refer to: ① Low exchange rates (weak dollar), ② Low oil prices, ③ Low interest rates. Among these, dollar weakness is most critical, with the other two factors carrying roughly equal importance.

The challenge is that this "Three Lows" combination rarely occurs. It's unusual for oil prices to remain subdued when the dollar weakens, and it's uncommon for interest rates to stay low during strong economic conditions. Yet this difficult-to-achieve combination is materializing for the first time in 40 years since 1986.

From a long-term perspective, the environment of low exchange rates, low interest rates (due to financial repression), and low oil prices is expected to persist.

Investment Strategy and Timing

The combination of supportive policies (such as dividend tax separation) and the "Three Lows" environment will likely drive Korean equities significantly higher.

So when should investors consider taking profits? The primary catalyst for a future bear market (-20% range) will likely be inflation, and based on current analysis, this risk isn't expected to materialize until sometime in the second half of next year.

The confluence of continued "Three Lows" conditions and market stimulus measures suggests the rally has room to run, with inflation resurgence in late 2024 being the key risk to monitor.